What's Changing with Affordability Assessments & Why Should Lenders Care?

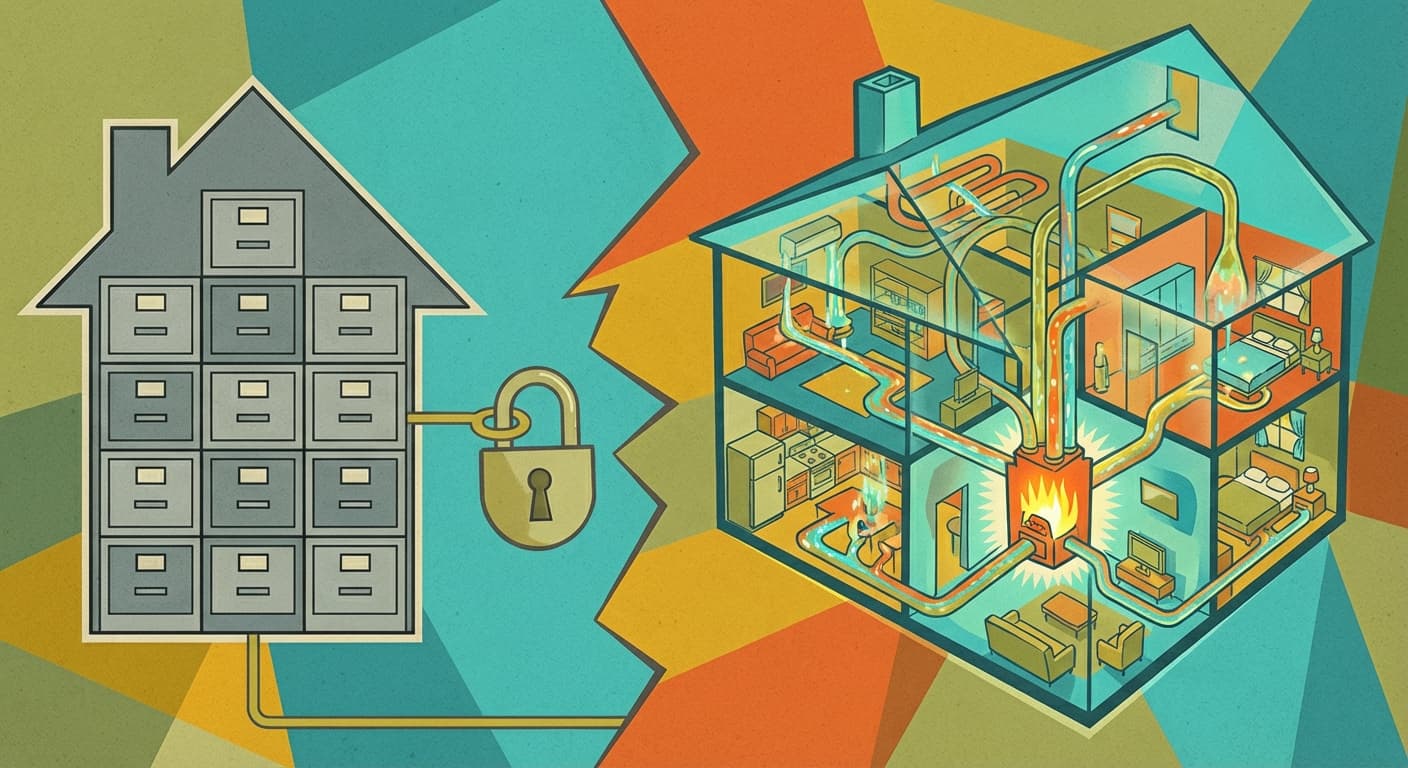

Mortgage affordability assessments are undergoing a significant transformation, driven by regulatory changes, technological advancements, and evolving customer expectations. Traditional methods, often relying on static income data and broad-brush expense estimates, are becoming increasingly inadequate. Lenders need to embrace more dynamic, data-driven approaches to ensure accurate, fair, and compliant affordability assessments.

Key Drivers of Change:

The Mortgage Market Review (MMR) and Subsequent Updates: The MMR introduced stricter affordability rules, and ongoing regulatory scrutiny continues to emphasise responsible lending.

Open Banking: Provides access to real-time transaction data, enabling a more granular and accurate assessment of a borrower's financial situation.

Cost of Living Crisis: Rising inflation and increased living expenses are impacting borrowers' affordability, requiring lenders to consider these factors carefully.

Technological Advancements: AI and machine learning are enabling more sophisticated and predictive affordability models.

Consumer Duty: Lenders need to prove value and understand customer's financial positions.

How Affordability Assessments are Evolving:

From Static to Dynamic: Moving away from point-in-time assessments to continuous monitoring of a borrower's financial situation.

From Broad Estimates to Personalised Data: Utilising real-time transaction data to understand a borrower's actual spending patterns and financial commitments.

From Manual Reviews to Automated Processes: Leveraging technology to automate data collection, analysis, and decision-making.

From Basic Income Verification to Holistic Financial Assessment: Considering a wider range of factors, including alternative income sources, debt obligations, and potential future expenses.

Challenges & Considerations:

Data Privacy and Security: Handling sensitive financial data requires robust security measures and strict adherence to data protection regulations.

Data Interpretation: Making sense of large volumes of transaction data and identifying relevant patterns requires advanced analytics capabilities.

Model Explainability: Lenders need to be able to explain how affordability decisions are made, both to customers and to regulators.

Fairness and Bias: Ensuring that affordability models do not discriminate against certain groups of borrowers is crucial.

What’s Next?

The future of mortgage affordability assessments is data-driven, dynamic, and personalised. Lenders who embrace these changes will be better positioned to make accurate and responsible lending decisions, improve customer experience, and comply with regulatory requirements. Chimnie's property data, combined with Open Banking and other data sources, can provide a powerful foundation for next-generation affordability assessments.

Want to discuss how to build more robust and future-proof affordability models? Let's talk. Get in touch at hello@chimnie.com to explore how Chimnie can support your affordability assessment strategy.