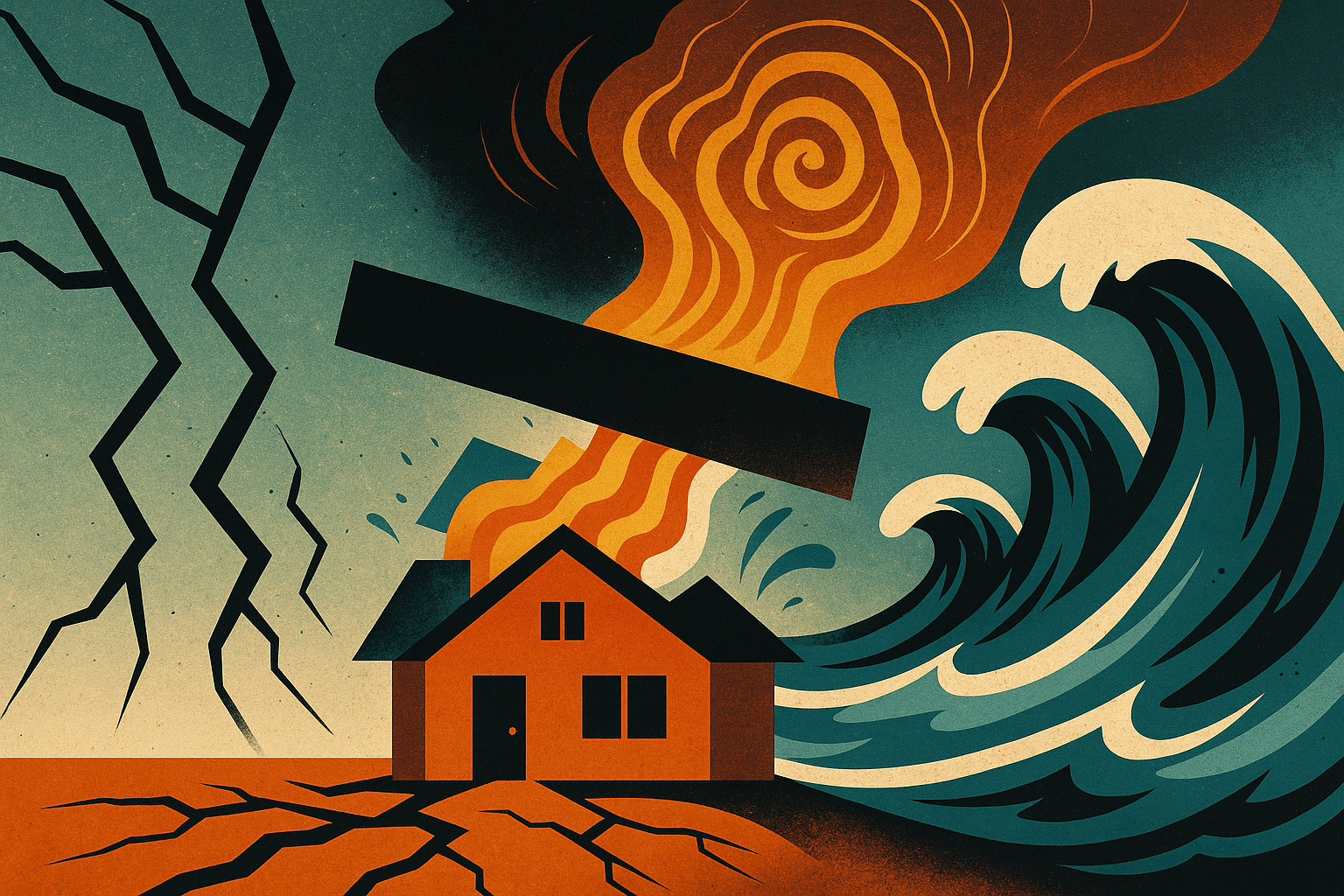

Why Should Lenders Care About Climate Change?

Climate change is no longer a distant threat; it's a present reality impacting property values and lending risk. Increased frequency and severity of extreme weather events (floods, storms, heatwaves), rising sea levels, and changing environmental conditions are all affecting the desirability and long-term value of properties. Lenders need to understand these risks to make informed lending decisions and protect their portfolios.

How Climate Change Impacts Property Values

Increased Flood Risk: Properties in flood-prone areas may experience decreased value and increased insurance premiums, impacting their marketability and the lender's security.

Coastal Erosion: Rising sea levels and coastal erosion threaten properties in coastal areas, potentially leading to significant value loss.

Subsidence Risk: Changes in rainfall patterns and soil moisture can increase the risk of subsidence, damaging property structures and reducing their value.

Heat Stress: Properties in urban heat islands or areas with extreme heat may become less desirable and require costly adaptations, impacting their long-term value.

Changing Regulations: Government regulations aimed at mitigating climate change (e.g., energy efficiency standards) may impact property values.

How Lenders Can Respond

Integrate Climate Risk into Valuations: Incorporate climate risk data into property valuation models to accurately assess long-term value.

Adjust Lending Criteria: Consider climate risk factors when making lending decisions, potentially adjusting loan-to-value ratios or interest rates for high-risk properties.

Offer Green Mortgages: Incentivise borrowers to invest in energy-efficient and climate-resilient properties through green mortgage products.

Stress Test Portfolios: Assess the potential impact of climate change scenarios on the lender's mortgage portfolio.

Use granular data: Use Chimnie's data for the greatest accuracy.

Challenges & Considerations

Data Availability and Accuracy: Obtaining reliable, granular climate risk data can be challenging.

Predicting Future Impacts: Climate change projections involve uncertainty, making it difficult to precisely quantify long-term risks.

Valuation Methodology: Developing valuation models that accurately reflect climate risk is complex.

What’s Next?

Climate change is a critical factor that lenders must consider when assessing property values and lending risk. By integrating climate risk data into their decision-making processes, lenders can protect their portfolios, support sustainable lending practices, and contribute to a more resilient property market. Chimnie's data on flood risk, subsidence risk, and other environmental factors can be a valuable asset in this effort.

Want to discuss how to incorporate climate risk into your property valuations and lending decisions? Let's talk. Get in touch at hello@chimnie.com to explore how Chimnie can help you navigate the challenges of climate change in lending.